Best Envelope Budgeting Apps to Manage Your Money in 2025

In today’s fast-paced world, managing money wisely is crucial. With rising expenses, financial uncertainty, and countless subscription services, sticking to a budget can feel overwhelming. That’s where Envelope Budgeting Apps come in. By combining the traditional envelope system with modern technology, these apps make it easy to track spending, save for goals, and maintain financial discipline.

Whether you’re just starting your financial journey or are experienced at budgeting, choosing the right envelope budgeting app in 2025 can help you take control of your money like never before. Let’s explore what these apps are, why they work, and which ones you should consider using this year.

What Are Envelope Budgeting Apps and Why Are They Effective?

The Traditional Envelope System Explained

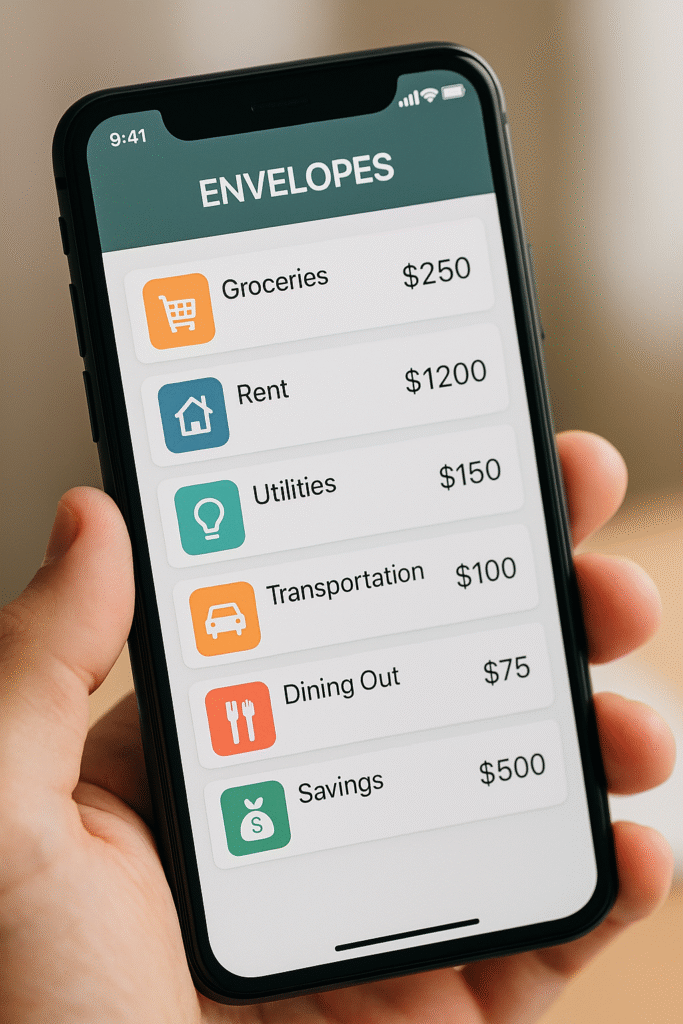

The envelope budgeting method has existed for many years. People would usually divide their income into physical envelopes labeled for categories such as groceries, rent, entertainment, and savings. Once the cash in an envelope was gone, you couldn’t spend any more in that category.

How Digital Envelope Budgeting Apps Work

Nowday, envelope budgeting apps apply this principle in a digital way. Instead of putting cash into paper envelopes, you create digital envelopes for each spending category. These apps connect with your bank accounts, track your expenses in real time, and notify you when you are nearing your budget limit.

This straightforward but effective system helps you meet your financial goals without feeling limited.

Key Benefits of Using Envelope Budgeting Apps in 2025

Improved Financial Discipline

With clear spending categories, envelope apps help you manage purchases and follow your plan.

Real-Time Expense Tracking

Most apps connect directly to your bank accounts and credit cards. This gives you instant insights into where your money is going.

Goal-Oriented Savings Features

Many apps let you set savings goals, whether it’s an emergency fund, a vacation, or a down payment on a house. You can allocate money into envelopes for each goal.

Factors to Consider When Choosing the Right Envelope Budgeting App

Before choosing an app, think about these factors:

- User Interface and Ease of Use: The app should be simple enough for beginners and powerful enough for advanced users.

- Compatibility Across Devices: A good app should work smoothly on iOS, Android, and desktop.

- Pricing and Subscription Models: Some apps are free while others charge a monthly fee for premium features.

- Security and Data Protection: Make sure the app uses encryption and two-factor authentication to keep your financial data safe.

Top 7 Best Envelope Budgeting Apps to Manage Your Money in 2025

Here are the best apps that stand out this year:

This is a user-friendly app that’s great for beginners. It allows manual expense tracking and envelope allocation.

2. Mvelopes – A Classic Choice for Digital Envelope Budgeting

Mvelopes follows the traditional envelope system closely. It helps users manage their spending habits well.

YNAB goes beyond envelope budgeting and teaches zero-based budgeting principles. It’s ideal for those who want detailed financial planning.

4. EveryDollar – Dave Ramsey’s Budgeting Approach

EveryDollar is built on Ramsey’s financial principles. It’s meant for users dedicated to a debt-free lifestyle.

5. PocketGuard – Envelope Budgeting with Smart Insights

This app helps with budgeting, analyzes spending patterns, and suggests ways to save.

6. Fudget – Minimalist Budgeting Made Easy

Fudget is a simple app that suits those who want straightforward budgeting without extra features.

7. Zeta – Best for Couples and Shared Finances

Zeta is designed for couples, allowing partners to manage shared and personal budgets transparently.

Common Mistakes to Avoid with Envelope Budgeting Apps

Over-Complicating Your Budget Categories

Too many envelopes can make budgeting overwhelming. Stick to broad categories for clarity.

Ignoring App Notifications and Reports

These reminders help you stay on track. Ignoring them reduces the app’s effectiveness.

Switching Apps Too Frequently

Consistency is key. Constantly changing apps stops you from building healthy budgeting habits.

FAQs About Envelope Budgeting Apps

Q.1: Are envelope budgeting apps free to use?

Some apps, like Fudget and Zeta, have free versions. Others, like YNAB and Mvelopes, charge monthly fees for extra features.

Q.2: Can envelope budgeting apps replace traditional budgeting methods?

Yes, many people find digital envelope apps more convenient because they track and report automatically.

Q.3: Which envelope budgeting app is best for beginners?

Goodbudget is a great starting point. It’s simple, easy to use, and beginner-friendly.

Q.4: Are these apps safe for linking bank accounts?

Most reputable apps use bank-level encryption and two-factor authentication to protect your data. Always check the security policies before connecting your accounts.

Q.5: How do envelope budgeting apps help with debt repayment?

These apps let you set aside specific funds for different debt categories. This helps you make consistent payments and avoid overspending.

Q.6: What’s the difference between envelope budgeting and zero-based budgeting?

Envelope budgeting sets money aside into categories. Zero-based budgeting makes sure every dollar has a purpose. Some apps, like YNAB, combine both methods.

Leave a Reply