Introduction to LSSC Investment

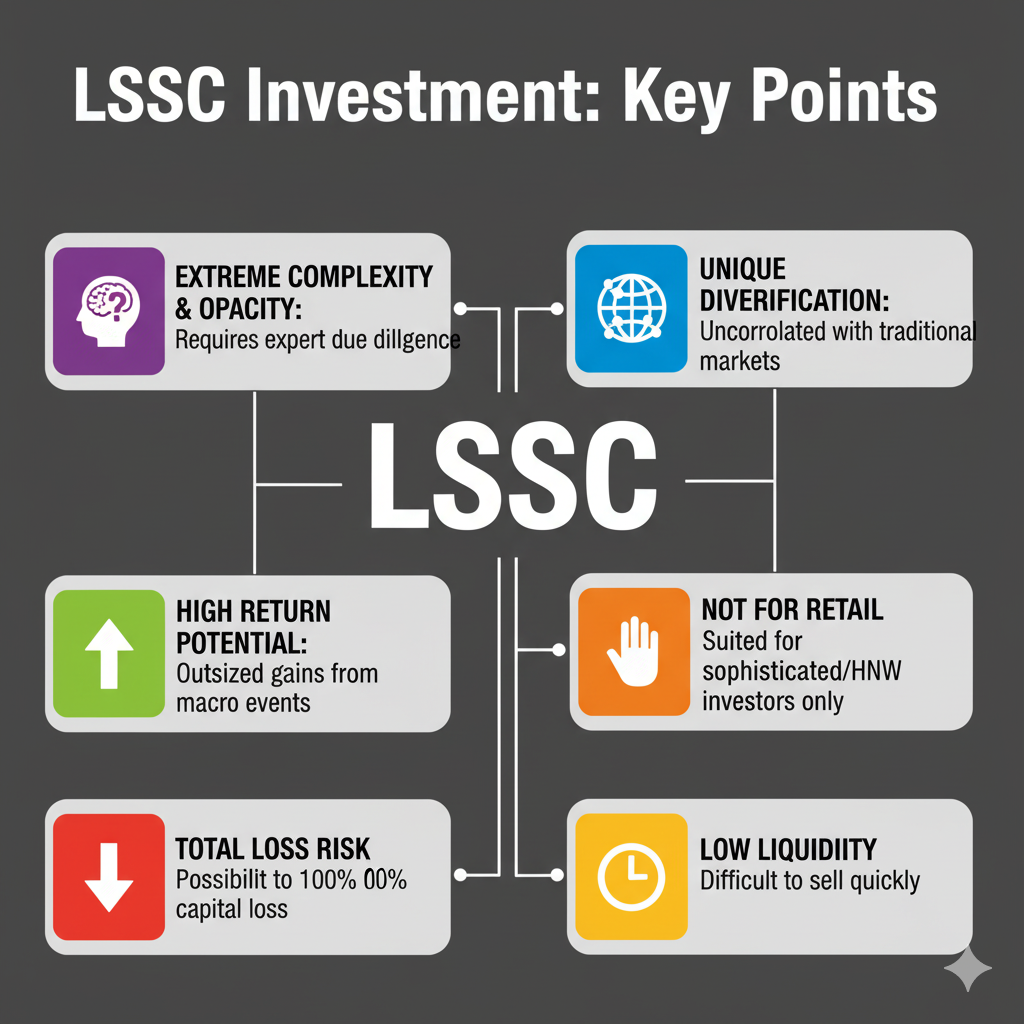

Ever come across the term “LSSC investment” and felt like you’ve hit a wall of financial jargon? You’re not alone. It’s an acronym that often causes confusion, sometimes mistaken for a stock ticker or a specific company. In reality, it stands for Listed State-Contingent Securities—a sophisticated and high-stakes financial instrument that’s a world away from your average stock or bond. If you’re an investor in the UK or the USA looking for the next frontier of portfolio diversification, understanding LSSCs is crucial.

This guide is designed to cut through the complexity. We’ll demystify what an LSSC investment really is, how it works, and who should—and shouldn’t—consider adding it to their portfolio. We’ll explore the tantalizing potential for high returns, but also cast a sober light on the significant risks involved. From practical examples to comparisons with other alternative investments, you’ll walk away with a clear understanding of this niche corner of the financial world. Let’s dive in and decode the puzzle of LSSC investing.

Decoding LSSC Investment: What Does It Actually Mean?

Before we can analyze the pros and cons, we first need to get our definitions straight. The term “LSSC” is a prime example of how financial acronyms can be misleading. Let’s clear up the confusion and establish exactly what we’re talking about.

The “LSSC” Acronym Puzzle: Common Misconceptions

If you search for “LSSC investment” online, you’re likely to find a mixed bag of results. Many refer to the old stock ticker for companies like Luminar Technologies or other firms with similar initials. It’s a classic case of mistaken identity. For the average investor, these results are red herrings.

The LSSC we’re discussing here is not a company, but a category of investment. It’s an umbrella term for a type of security whose performance is directly tied to a future event or condition—a “state of the world.” Forgetting this distinction is the first mistake many make. So, let’s discard the stock tickers and focus on the actual financial instrument.

How Do State-Contingent Securities Work in Practice?

Theory is one thing, but how does an LSSC investment function in the real world? The mechanism is similar to a structured product or a derivative, where financial engineering is used to create a unique risk-and-reward profile. The goal is often to hedge against specific economic risks or to speculate on their outcomes.

The Core Mechanism: Tying Payouts to Economic Events

Common triggers for these state-contingent debt instruments can include:

- GDP Growth: A bond’s interest payments might increase if the issuing country’s GDP exceeds a certain target. This was proposed as a way for countries like Greece to manage their debt after the 2008 financial crisis. If the economy does well, they can afford to pay more; if it struggles, the debt burden eases (IMF, 2017).

- Inflation Rates: A security might offer a higher payout if inflation surpasses a central bank’s target, protecting the investor from losing purchasing power.

- Commodity Prices: A bond issued by an oil-exporting nation might have its payout linked to the price of crude oil.

- Natural Disasters: So-called “catastrophe bonds” are a type of state-contingent security. They pay a high yield, but if a specified natural disaster (like a major hurricane in Florida) occurs, the investor can lose their entire principal, which is then used to pay insurance claims.

Investopedia. (2022). Contingent Convertible (CoCo) Bond. Retrieved from https://www.investopedia.com/terms/c/contingentconvertible.asp

Pros of LSSC Investing

With such a complex structure, why would anyone bother with an LSSC investment? The answer lies in its unique ability to offer benefits that are hard to find in traditional markets. For the right type of investor, LSSCs can be a powerful tool.

1. The Allure of High Returns

The most obvious attraction is the potential for outsized returns. Because the payouts are tied to specific, often volatile, events, the “kicker” payments can be substantial. In our GDP-linked bond example, earning 7% in a world where standard government bonds yield 4% is a significant premium.

2. Portfolio Diversification with Uncorrelated Assets

This is perhaps the most intellectually compelling reason to consider LSSCs. A core principle of modern portfolio theory is diversification—holding assets that don’t all move in the same direction. The problem is that during a major crisis, seemingly different assets (like stocks from the US, UK, and Japan) all tend to fall together. Their correlation increases.

Cons of LSSCs

While the potential upside is enticing, the path of an LSSC investor is fraught with peril. These are not instruments for the faint of heart or the inexperienced. Understanding the downside is even more critical than being seduced by the potential returns.

1. Complexity and Lack of Transparency

The single biggest barrier is complexity. The legal documents (prospectuses) governing these securities can be hundreds of pages long, filled with convoluted legal and financial language. Defining the “trigger event” is a minefield of its own.

2. Liquidity Risk: The Challenge of Selling

While they are “listed,” many LSSCs are very thinly traded. This means there might not be many buyers when you want to sell. If you need to liquidate your position quickly, you might be forced to sell at a steep discount to its theoretical value—if you can find a buyer at all. The “listed” label can create a false sense of security.

3. The Specter of Total Loss

With many LSSCs, particularly those structured like catastrophe bonds, the risk isn’t just underperformance; it’s the complete and total loss of your initial investment. If the trigger event occurs, your principal can be wiped out. This binary, “all-or-nothing” outcome is far removed from traditional stock investing, where even a bankrupt company often has some residual asset value

LSSC Investments vs. The Alternatives

To better understand where LSSCs fit, it’s helpful to compare them to other financial instruments, both complex and conventional. Where does an LSSC sit on the broader investment landscape?

Comparison with CoCo Bonds and Catastrophe Bonds

- CoCo Bonds: These are issued primarily by banks. They are hybrid bonds that convert into equity (stock) if the issuing bank’s capital ratio falls below a certain trigger level. Like an LSSC, their behavior is state-contingent. The “state” is the financial health of the bank. They offer high yields but risk being converted to stock precisely when the bank is in trouble, leading to heavy losses.

- Catastrophe Bonds: As mentioned earlier, these are a specific type of LSSC where the “state” is a natural disaster. They are a pure play on insurance risk and are almost entirely uncorrelated with financial markets.

How Do They Differ from Traditional Stocks and Bonds?

- Risk Source: The value of a stock is tied to the performance of a single company (its profits, management, and industry). A traditional bond‘s risk is primarily tied to interest rates and the issuer’s creditworthiness. An LSSC’s risk is tied to an external, often macroeconomic, event that has little to do with company performance or standard interest rate cycles.

- Payout Structure: Stocks offer ownership and potential for capital growth. Bonds offer fixed (or floating) interest payments. LSSCs have a binary or conditional payout structure that is highly variable and depends entirely on the trigger event.

- Purpose in a Portfolio: Stocks are for growth. Bonds are for income and stability. LSSCs are primarily for sophisticated diversification and high-risk speculation. They are not a core holding but a satellite one, used to add a unique risk-return profile that is deliberately disconnected from the main portfolio.

Conclusion: The Final Verdict on LSSC Investments

The world of LSSC investment is a fascinating but treacherous one. It represents the cutting edge of financial innovation, creating instruments that allow investors to take direct stakes in macroeconomic outcomes, from GDP growth to the frequency of hurricanes. For institutional investors and the ultra-wealthy, these securities can serve as a powerful tool for achieving a level of portfolio diversification that is simply unattainable through conventional assets. The ability to hedge against systemic risks or generate yield from sources completely untethered from the stock market is a compelling proposition.

However, this power comes at a steep price: immense complexity, a glaring lack of transparency, and the very real possibility of losing every penny invested. For the vast majority of individual investors in the UK and USA, the verdict is clear. The risks associated with LSSCs far outweigh the potential rewards. The knowledge and resources required to perform adequate due diligence are beyond the reach of most, making it a gamble rather than an investment. While the idea of a high-risk high-return security is tempting, true financial success is more often built on a foundation of understandable, accessible, and well-regulated investments.

Frequently Asked Questions (FAQs)

1. Can I buy an LSSC investment through my regular online broker? Generally, no. Due to their complexity and risk, LSSCs are typically not available on standard retail brokerage platforms in the USA or UK. They are usually sourced through private banks, wealth management firms, or institutional trading desks that cater to sophisticated and high-net-worth clients.

2. What is the difference between an LSSC and a derivative like an option? While both have payouts that are contingent on a future event, they differ in structure. An LSSC is typically a debt instrument (a bond) with a conditional payout feature. A derivative like an option is a contract that gives the holder the right, but not the obligation, to buy or sell an underlying asset at a set price. The legal framework and trading mechanics are quite different.

3. Are there any LSSC ETFs or funds available? There are specialized funds, often hedge funds or private funds, that invest in these types of securities, particularly in the catastrophe bond space. However, a publicly traded ETF that retail investors can easily buy is very rare, if not non-existent, due to the illiquidity and complexity of the underlying assets.

4. How are LSSC investments taxed in the UK and USA? The tax treatment can be extremely complex and depends on the specific structure of the security. Payouts might be treated as capital gains or as income, and the rules can vary significantly. This is a critical area where you must consult a tax professional in your specific jurisdiction before making any investment.

5. What were the first state-contingent debt instruments? The concept isn’t entirely new. Economists have proposed ideas like GDP-linked bonds for decades as a way to make sovereign debt more sustainable for developing nations. The Bank of England has published discussions on these instruments, noting their potential to help governments manage economic shocks (Bank of England, 2018). However, their actual implementation and listing on public exchanges remain relatively limited.

Leave a Reply