Introduction to Yrefy Investment

In today’s low-interest environment, many investors are looking beyond traditional bonds and savings accounts. Enter alternative credit vehicles—niche, fixed-income-style investments that may offer higher yields but also carry unique risks. One such opportunity is the Yrefy, LLC investment. In this post we’ll explore what Yrefy investment is, how it works, the benefits and risks, who it may suit, and how you should evaluate it before committing capital.

What is Yrefy?

Yrefy, LLC is a U.S.-based specialty finance company that focuses on an unusual corner of lending: the refinancing of distressed or defaulted private student loans. finlocity.com

Here’s a quick summary of the business model and background:

Founded in 2017 (per Finlocity) with a mission to assist borrowers burdened by delinquent or defaulted private student-loan debt.

Its core strategy: buy or negotiate distressed private student-loan portfolios (often at steep discounts), refinance them into newer loans with fixed rates, then service the loans and manage repayments.

On the investor side, Yrefy offers promissory-note private placements under Regulation D (506(c)) for accredited investors only. These promissory notes are backed by the portfolio of refinanced loans. InvestorPage

According to Yrefy’s investor-site, the minimum investment is US$50,000, and available terms range from 12 to 60 months with fixed rates (e.g., up to 10.25% annual for a 60-month class) based on class choice. InvestorPage

So when you talk about “Yrefy investment” you are generally referring to investing in Yrefy’s promissory-notes tied to their private student-loan refinancing business. The investment takes the form of fixed-term notes offered to accredited investors, not publicly traded securities.

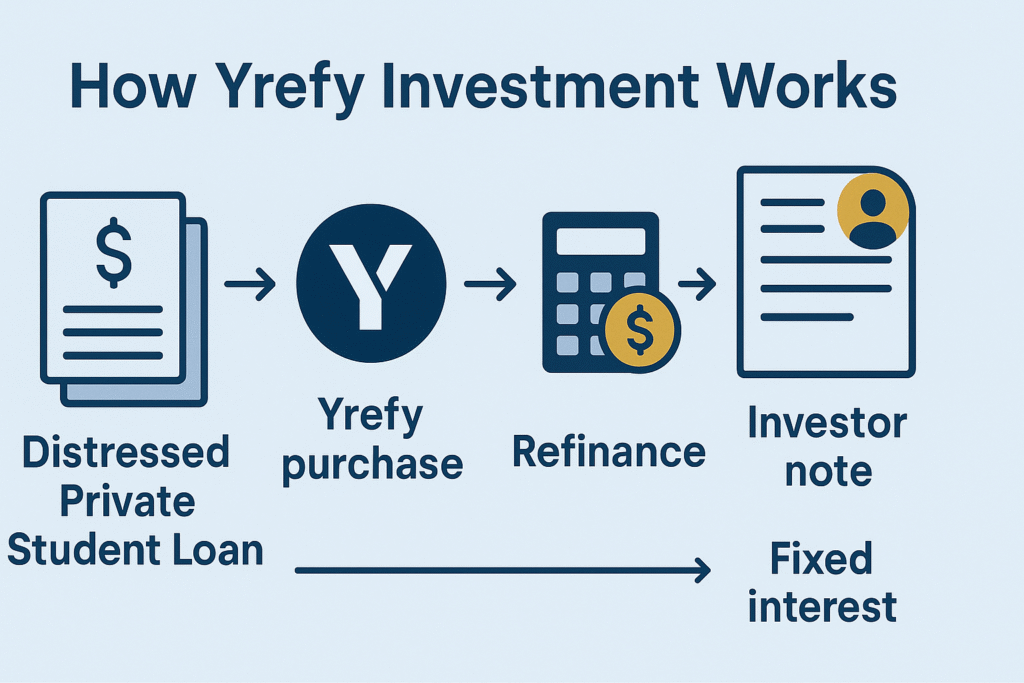

How the Yrefy Investment Works

Borrower side (Yrefy’s business)

Yrefy identifies defaulted or delinquent private student-loan accounts (not federal loans) and negotiates with original lenders/servicers to purchase or refinance these loans at a discount.

Yrefy then offers the borrower a new loan with a fixed interest rate and a structured repayment plan tailored to their ability to pay, aiming to rehabilitate the loan and get steady repayments. Education Data Initiative

Yrefy serves or oversees servicing of the loan, collects payments, manages credit/collections, etc.

Investor side (how your money works)

- As an investor you buy a promissory note issued by Yrefy (via their private placement). The proceeds of that note are used by Yrefy to purchase and refinance distressed private loans.

- You choose among classes (for example:

- Class 1: 12-month term, 6.50% fixed annual interest

- Class 2: 24-month term, 7.00%

- Class 3: 36-month term, 7.75%

- Class 4: 48-month term, 8.50%

- Class 5: 60-month term, 10.25% ) I

- You may elect to receive monthly interest payments or let interest accrue until maturity (depending on the class).

- Liquidity is limited. Early redemptions are subject to Yrefy’s approval and may incur fees or restrictions. There is no established public market for the notes.

Key Features & Benefits of a Yrefy Investment

Here are some of the potential benefits of investing in Yrefy, from the investor’s perspective:

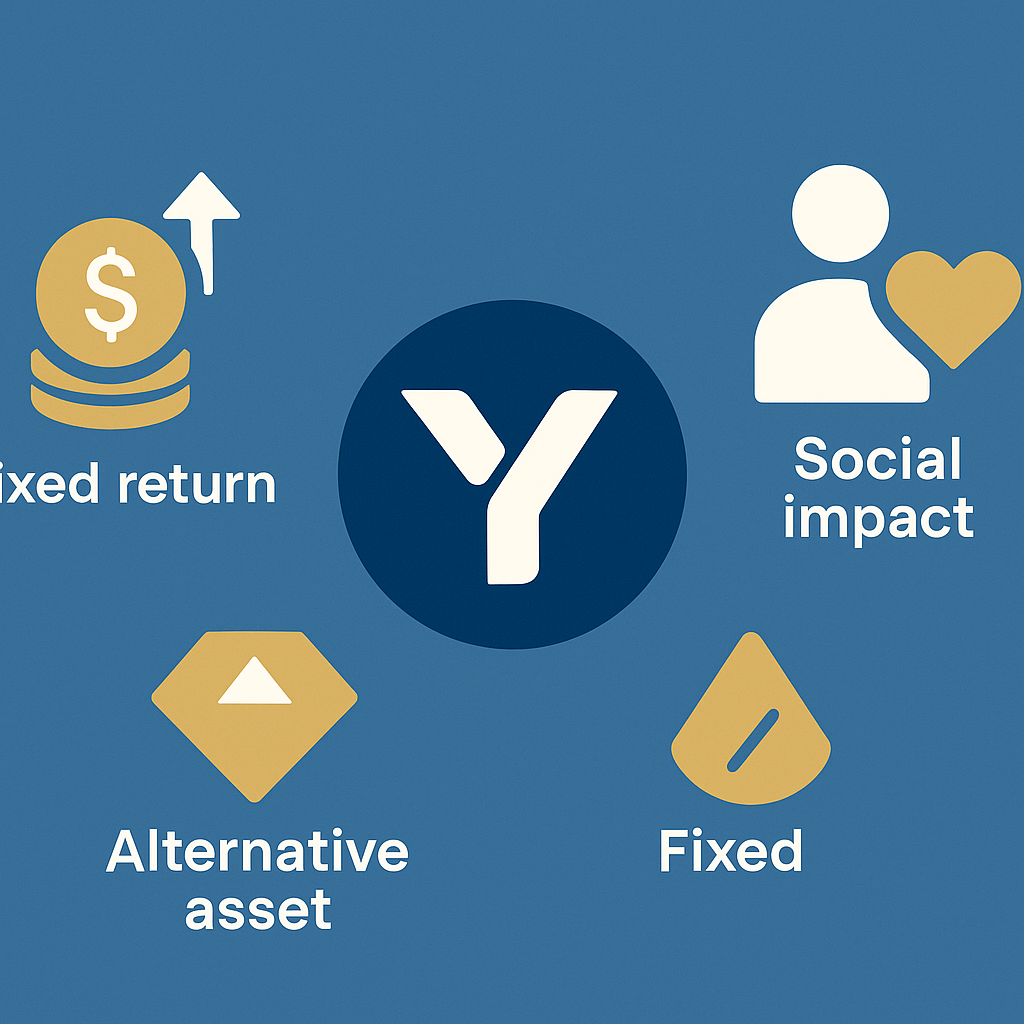

Attractive fixed-rate return – Yrefy offers fixed annual interest rates up to ~10.25% on the 5-year note class. That is materially higher than many investment-grade corporate bonds or bank products.

Alternative asset class / non-correlated exposure – The investment is in a niche credit area (distressed private student loans), which may have different dynamics than traditional corporate credit or public bonds.

Social impact angle – There’s a dual purpose: the borrower side gets refinancing help, and the investor side gets returns. Some investors like the idea of “impact + yield”.

Term options and compounding flexibility – Investors can choose shorter or longer terms (1-5 years) and elect monthly interest or accrual for compounding. This gives some flexibility in matching asset-liability horizons.

Portfolio diversification – For investors comfortable with private credit, Yrefy stands out as a distinct line of exposure.

Risks & Considerations

No investment is without risk, and the Yrefy investment comes with several important considerations. It’s essential to weigh these carefully.

In short, the potential reward is higher, but the risk profile is meaningfully elevated compared to many simpler fixed-income options.

Who Should Consider a Yrefy Investment?

It may be suitable for:

Accredited investors who are comfortable with private credit, illiquid investments, and potentially higher risk for higher return.

Investors seeking alternative fixed-income exposure outside of publicly traded bonds, looking for yields in the 7-10% range (depending on class).

Investors with a suitably long investment horizon (1-5 years) who can tie up capital and tolerate limited liquidity.

Those who understand and are comfortable with credit/operational risk and have the capability to perform due diligence (or engage advisors).

Investors who like the social-impact dimension of helping borrowers in distress (though this should not be the primary driver without assessing returns/risks).

It may not be suitable for:

Investors needing high liquidity or a marketable, publicly tradable investment — this is not one.

Investors who prioritise capital preservation above all and cannot tolerate the possibility of principal loss.

Investors who are not accredited or who do not meet the suitability criteria for private placements.

Those who are risk-averse, unfamiliar with private credit, or unable to perform detailed due diligence.

Steps to Take Before Investing in Yrefy

1.Confirm accredited investor status

ensure you meet the definition (income, net worth, etc) or the investment is unsuitable.

2. Request and review the Private Placement Memorandum (PPM)

this is the core legal/financial document. It will detail terms, fees, risks, redemption policy, use of proceeds, etc.

3. Understand term

figure out which class you invest in, fixed rate, maturity, whether you can extend or roll into longer term.

4. Review how underlying loans are originated or purchased

ask about underwriting, default history, discount-to-capital cost, borrower profiles, state law compliance.

4. Review how underlying loans are originated or purchased

what happens if you want to exit early? What are the redemption rules and fees?

5. Ask about tax

private placements often have specific tax/structuring issues. Consult your legal or tax advisor.

6. Monitor ongoing performance

once invested, get access to the investor portal, statements, asset-performance data, and ensure transparency.

By going through these steps you reduce the chance of unpleasant surprises and ensure the investment aligns with your goa

Conclusion

A “Yrefy investment” refers to investing in the promissory-notes issued by Yrefy, LLC—a company specialising in refinancing and servicing distressed private student loans for borrowers.

The opportunity offers potentially attractive fixed yields (up to ~10.25% for 5-year term) for accredited investors who accept illiquidity, operational risk and borrower-credit risk.

There are meaningful risks: limited liquidity, elevated default risk, niche borrower base, and reliance on Yrefy’s execution.

This investment may suit investors seeking alternative fixed-income exposures, comfortable with private credit and illiquidity. It is not suitable for those needing high liquidity, minimal risk or easy public market access.

As with any private placement, rigorous due diligence is essential — understanding the PPM, term structure, borrower portfolio, servicing, fees, and how this fits your broader portfolio is vital.

If you decide to invest, allocate it as part of a diversified strategy (not your entire portfolio), monitor performance carefully, and be prepared to hold to maturity (or accept the possibility you may not exit early easily).

FAQ about Yrefy investment

Q1: What is a Yrefy investment?

A Yrefy investment involves buying a promissory note issued by Yrefy, LLC (accredited-investor only) that funds the refinancing of distressed private student loans. You receive a fixed interest rate over a specified term.

Q2: Is investing in Yrefy safe?

“Safe” is relative. Compared to a government bond it’s far riskier—there is borrower default risk, illiquidity, reliance on Yrefy’s business execution. If you understand and accept these risks, it may be a considered investment. But principal loss is possible.

Q3: What are the returns on a Yrefy investment?

Returns depend on the class selected: according to Yrefy’s website, the 5-year class is up to ~10.25% fixed annual interest. Other shorter-term classes carry lower returns (for example ~6.50% for 12 months) as per current offering.

Q4: How do the Yrefy LLC promissory notes work?

You invest via a Regulation D (506(c)) private placement. Yrefy uses your capital to purchase/refinance distressed private student-loan debt. You pick the term (12-60 months), decide whether to receive monthly interest or let interest accrue, and at maturity you receive principal + interest (assuming performance). Liquidity is limited and early redemption is conditional. Q5: Can I compare investing in Yrefy with investing in the student-loan market more broadly?

Yes — this is a private-credit play in the student-loan niche. Compared to buying publicly traded student-loan securities or general consumer credit, this is more specialized and illiquid. If you’re comfortable with private credit exposures and niche risk, it may have a place; if not, more traditional vehicles may be more suitable.

Leave a Reply