Introduction to Aircraft Loan Calculator

Buying an aircraft is exciting, but it is also a major financial decision. Whether you are purchasing a small piston plane, a turboprop, or a private jet, the cost goes far beyond the sticker price. Interest rates, loan terms, and down payments can change your monthly obligation by thousands of dollars.

This is why serious buyers rely on a plane finance calculator before speaking with lenders. It helps you understand affordability, compare scenarios, and avoid surprises later in the financing process. Instead of guessing, you can see realistic loan costs in minutes and plan your purchase with confidence.

In this guide, you will learn how aircraft finance calculators work, what inputs matter most, and how to use them wisely when planning airplane ownership.

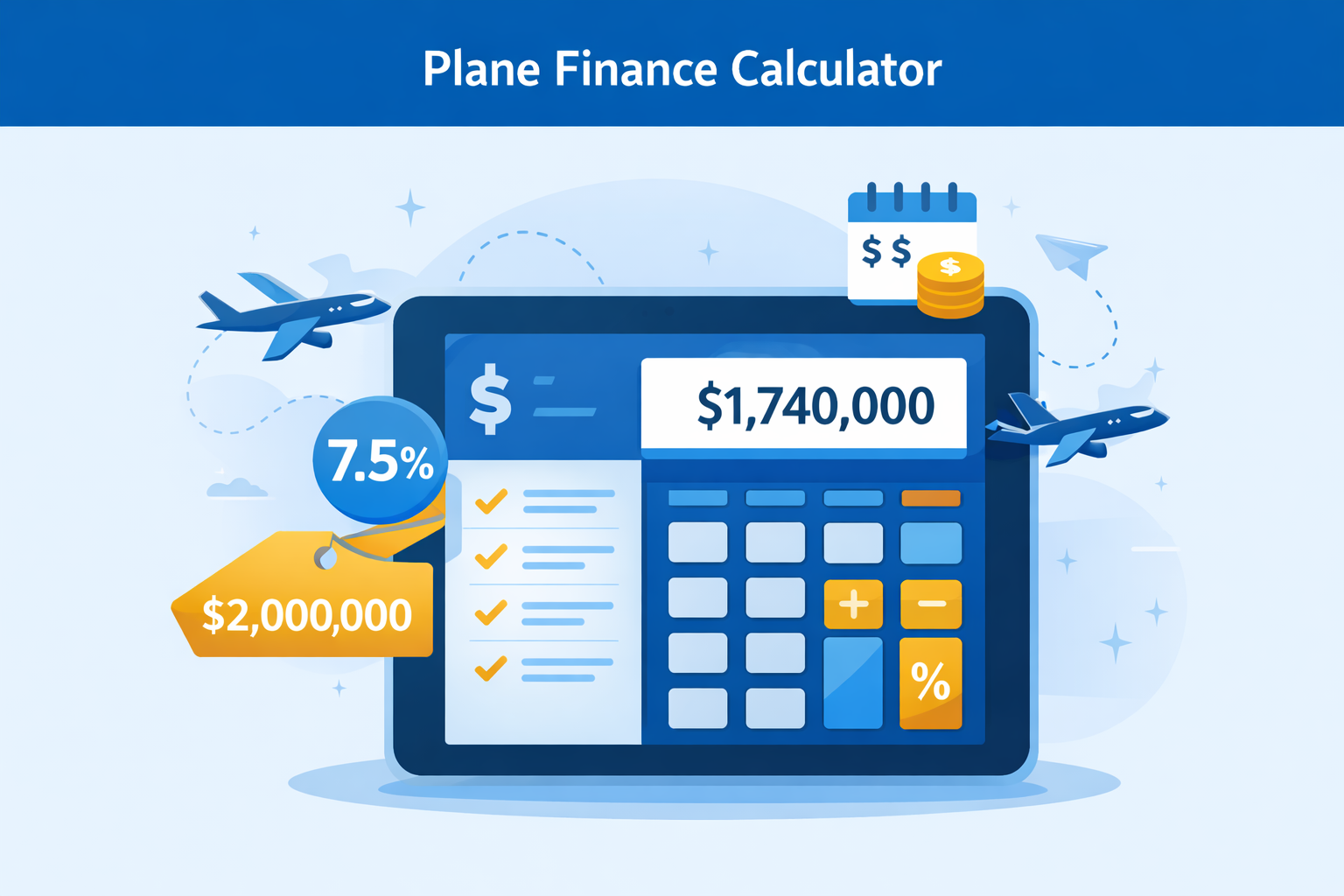

What Is a Plane Finance Calculator?

A plane finance calculator is an online tool that estimates the cost of financing an aircraft. It calculates expected monthly payments and total loan cost based on key variables such as price, interest rate, and loan length.

Think of it as a planning tool rather than a final quote. Lenders still determine exact terms, but calculators give buyers a reliable starting point.

Most calculators are used for:

General aviation aircraft

Business turboprops

Private jets

Used and new airplanes

Many buyers also refer to these tools as an aircraft loan calculator or airplane financing calculator. The purpose remains the same: to estimate loan obligations before committing.

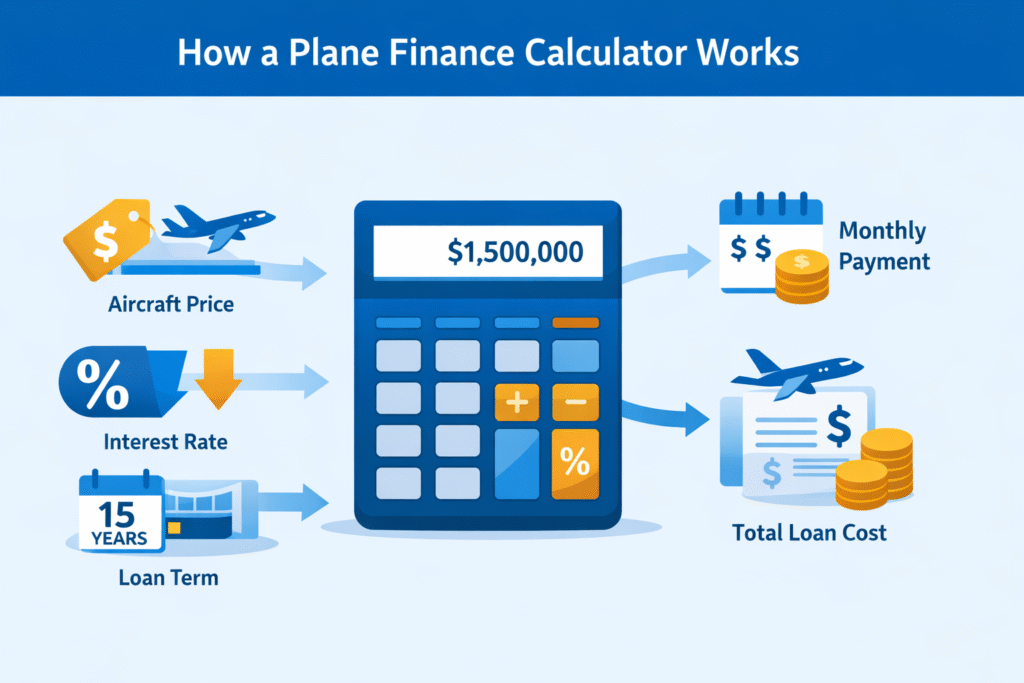

How a Plane Finance Calculator Works

An aircraft finance calculator follows a simple step by step process.

You enter the aircraft purchase price

This can be based on asking price or average market value.You add the down payment amount or percentage

Aircraft lenders usually require 10 to 30 percent down.You select an estimated interest rate

Rates depend on credit profile, aircraft age, and market conditions.You choose the loan term

Common terms range from 5 to 20 years.The calculator applies loan formulas

It uses standard amortization formulas similar to those explained by Investopedia in its guide to loan amortization

https://www.investopedia.com/terms/a/amortization.aspResults are displayed instantly

You see estimated monthly payment, total interest, and total repayment.

This allows quick comparison of different scenarios, such as higher down payment versus longer loan duration.

Inputs Used in Aircraft Financing Calculations

Understanding each input helps you interpret calculator results correctly.

Purchase Price

This is the negotiated cost of the aircraft. Buyers often reference valuation guides like Aircraft Bluebook to estimate fair market value

https://www.aircraftbluebook.com

Using a realistic price is critical. Overestimating can make financing look unaffordable, while underestimating leads to false confidence.

Down Payment

The down payment reduces the loan amount and lender risk.

Typical ranges:

10 percent for newer aircraft

20 to 30 percent for older planes or jets

A larger down payment usually means lower monthly payments and less interest paid.

Interest Rate

Aircraft loan rates vary based on:

Credit score

Aircraft age and type

Loan term

Market conditions

Educational resources like NerdWallet explain how interest rates affect borrowing costs

https://www.nerdwallet.com/article/finance/interest-rates

Rates for aviation loans are often higher than home mortgages but lower than unsecured personal loans.

Loan Term

Loan terms for aircraft are flexible compared to cars.

Common ranges:

5 to 10 years for light aircraft

10 to 15 years for turboprops

Up to 20 years for private jets

Longer terms lower monthly payments but increase total interest.

Aircraft Type

The type of aircraft matters more than many buyers expect.

Lenders consider:

Piston vs turboprop vs jet

New vs used

Manufacturer reputation

Market liquidity

Regulatory authorities like the FAA classify aircraft categories and airworthiness standards, which indirectly influence lender risk

https://www.faa.gov

In Europe, similar oversight comes from EASA

https://www.easa.europa.eu

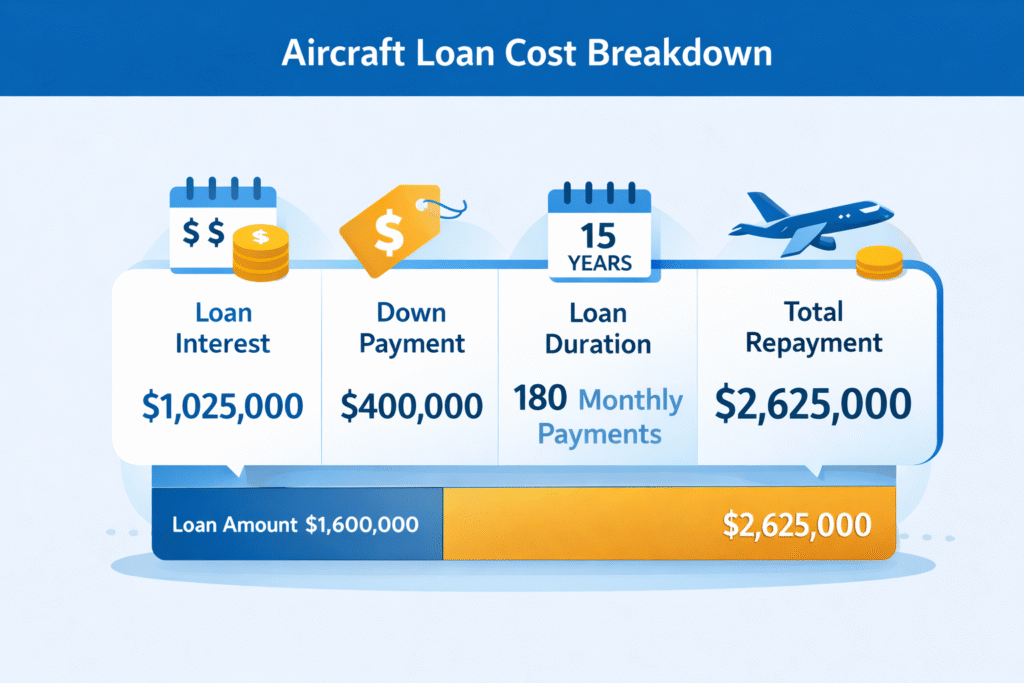

Example Plane Finance Calculation

Let us look at a realistic example to see how an aviation loan cost estimator works in practice.

Scenario:

A buyer wants to purchase a used turboprop aircraft.

Purchase price: $2,000,000

Down payment: 20 percent

Loan amount: $1,600,000

Interest rate: 7.25 percent

Loan term: 15 years

Factors That Affect Aircraft Loan Costs

Calculator results are only as accurate as the assumptions behind them. Several factors influence real world loan costs.

Credit Profile

Strong personal or business credit lowers interest rates. Aviation lenders look at:

Credit score

Debt to income ratio

Net worth

Liquidity

Aircraft Age and Condition

Older aircraft often:

Require higher down payments

Have shorter maximum loan terms

Carry higher interest rates

Maintenance history and logbooks also matter.

Market Conditions

Interest rates change with the broader economy. Financial publications like Forbes regularly explain how rate trends affect borrowing

Usage Type

Private use, charter, and corporate operation have different risk profiles. Charter aircraft usually need specialized financing and insurance.

Plane vs Private Jet Financing Differences

Financing a light airplane is not the same as financing a private jet.

Light Aircraft Financing

Lower purchase price

Shorter loan terms

Often financed by regional banks

Simpler underwriting

Private Jet Financing

High capital requirements

Longer loan terms possible

More documentation required

Often structured through aviation finance specialists

A private jet finance calculator typically includes higher down payments and longer amortization assumptions to reflect these realities.

When You Should Use an Aircraft Finance Calculator

Using a calculator early can save time and money.

Best times to use one include:

Before making an offer on an aircraft

When comparing different models

Before speaking with lenders

When planning cash flow for ownership

During negotiation to test alternative scenarios

It is especially helpful if you are a first time buyer unfamiliar with aviation lending norms.

Tips to Reduce Aircraft Financing Costs

Smart planning can significantly lower total loan expense.

Increase the Down Payment

Even an extra 5 percent down can save tens of thousands in interest.

Shorten the Loan Term

If cash flow allows, shorter terms reduce total interest dramatically.

Improve Credit Before Applying

Paying down existing debt and correcting credit report errors can improve loan offers.

Choose Aircraft With Strong Market Value

Well known manufacturers and popular models often receive better financing terms due to stronger resale value.

Compare Lenders

Different aviation lenders price risk differently. Never accept the first offer without comparison.

Conclusion

A plane finance calculator is one of the most valuable tools for anyone considering aircraft ownership. It transforms a complex financial decision into clear numbers you can understand and plan around.

Key points to remember:

Always use realistic inputs

Compare multiple scenarios

Understand what the calculator does and does not include

Treat results as estimates, not guarantees

By using calculators wisely and combining them with professional advice, you can approach aircraft financing with confidence and clarity.

Frequently Asked Questions

What is the purpose of a plane finance calculator?

It estimates monthly payments and total loan cost for aircraft financing based on price, interest rate, and loan term.

Are aircraft loan calculators accurate?

They are accurate for estimates but not final loan offers. Actual terms depend on lender approval and aircraft specifics.

Can I finance a used aircraft?

Yes. Many buyers finance used planes, though older aircraft may require higher down payments.

Do calculators include maintenance and fuel costs?

No. They focus only on loan payments, not operating expenses.

Is private jet financing harder than small plane financing?

Yes. Jets involve larger sums, stricter underwriting, and more documentation.

Leave a Reply