Introduction to aircraft finance calculator

Buying an airplane isn’t a casual purchase—it’s one of the biggest checks most owners will ever write. First single-engine? A step up to a light jet? Expanding a school’s training fleet? The mission changes, but the math still bites. And not just the sticker price.

Enter the aircraft finance calculator. It gives you a clear, working estimate of monthly payments, lets you stack financing options side-by-side, and reveals the real, long-term cost of owning the machine—not just the shiny rate on page one.

In this guide, we’ll show you how to get the most out of that calculator, unpack the variables that push your payment up or down, and share a few ways to borrow smarter (not merely cheaper). We’ll keep it practical, with friendly math and plain English, so you can make decisions with eyes open.

👉 Related Read: Before you jump into a big investment, learn how to Calculate HELOC Payment Easily for other major financial commitments.

What Is an Aircraft Finance Calculator?

An aircraft finance calculator is a straightforward web tool that helps you ballpark the full cost of financing an airplane. Think auto-loan calculator—only it speaks aviation.

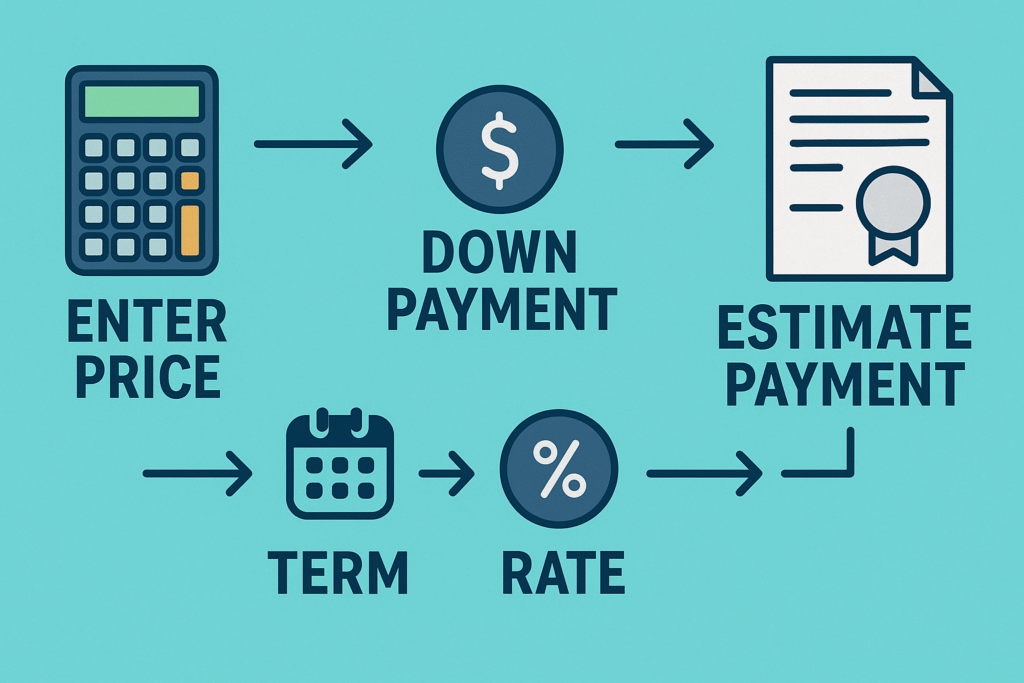

Per AOPA’s Financing Guide, most calculators let you plug in:

- Purchase price of the aircraft

- Loan amount or your down payment

- Interest rate

- Loan term (in years)

- Monthly insurance and maintenance (optional, but smart)

Why Use an Aircraft Finance Calculator?

When you’re staring down a purchase this big, guessing isn’t a plan. It’s a gamble. An aircraft finance calculator keeps you honest—and calm—by putting real numbers on the page.

Why it’s essential

- Clarity. See, instantly, what your monthly payment looks like. No surprises, just math.

- Comparison. Line up offers from banks and aviation lenders and spot the one that actually saves you money.

- Planning. Work in fuel, insurance, hangar fees—so your “can I afford this?” isn’t a shrug.

- Confidence. Make the call with eyes open, before you sign anything.

How to Use an Aircraft Finance Calculator

Most tools ask for only a handful of inputs:

- Enter Aircraft Price. The full purchase price or a solid market estimate.

- Input Down Payment. Commonly 15–20% of the price; more down usually means a friendlier payment.

- Set Loan Term. Aviation loans often run 5–20 years. Longer term = lower monthly, higher total paid.

- Enter Interest Rate. This varies with your credit, aircraft type, and lender. Even a small rate change moves the needle.

- Review Results. You’ll get an estimated monthly payment and the total repayment over the life of the loan—your quick reality check.

👉 Try this resource: Aircraft Finance Calculator by AOPA

Factors That Affect Aircraft Financing

Credit Score & Overall Profile

Your credit score still does the heavy lifting. Strong score, steady income, clean debt-to-income—rates tend to drop. If there are bumps (late pays, thin history), expect tighter terms or a higher rate.

Aircraft Type & Age

Airplanes aren’t all equal on a balance sheet. Newer models (and widely supported types) usually qualify for better rates and longer terms. Older airframes or niche models can fly—but lenders may shorten the term or nudge the rate up.

Loan Term

Stretch the term and the monthly shrinks. Nice for cash flow, but you’ll pay more interest over the life of the loan. Shorter term does the opposite: bigger payment now, less interest overall. No free lunch, just trade-offs.

Interest Rate

Tiny changes matter. A half-point tweak can move your monthly more than you’d think, especially on larger balances or longer terms. Locking at the right time helps; so does shopping offers.

Insurance & Maintenance

Financing doesn’t live in a vacuum. Insurance premiums, routine inspections, unexpected squawks—these are real, recurring costs. Build them into your budget alongside the loan so the airplane stays a joy, not a surprise.

Step-by-Step Example: Using an Aircraft Finance Calculator

Let’s plug in a realistic scenario:

- Aircraft price: $500,000

- Down payment: $100,000 (20%)

- Loan amount: $400,000

- Interest rate: 7% (fixed)

- Loan term: 15 years (180 months)

Run those numbers and you’ll land at about $3,595 per month—more precisely $3,595.31. Over 180 payments, that’s ~$647,156 in total paid to the lender, of which roughly $247,156 is interest. Small rounding differences between calculators will nudge this by a few dollars, but that’s the neighborhood.

Benefits of Using an Aircraft Finance Calculator

- Fast, decent estimates. Punch in a few numbers and get a monthly payment you can actually plan around.

- Guardrails against overborrowing. Seeing the payment in black and white keeps ambitions tethered to cash flow.

- Clear comparisons. Line up offers from different lenders and spot the one that really saves you money, not just the one with shiny marketing.

- Long-view planning. Map out ownership over years—not just the first month—so upgrades, maintenance, and reserves don’t blindside you.

Benefits of Using an Aircraft Finance Calculator

- Fast, decent estimates. Punch in a few numbers and get a monthly payment you can actually plan around.

- Guardrails against overborrowing. Seeing the payment in black and white keeps ambitions tethered to cash flow.

- Clear comparisons. Line up offers from different lenders and spot the one that really saves you money, not just the one with shiny marketing.

- Long-view planning. Map out ownership over years—not just the first month—so upgrades, maintenance, and reserves don’t blindside you.

Limitations to Keep in Mind

- Not every cost is included. Hangar, fuel, training, insurance, reserves—some calculators leave these out (or make them optional).

- Often assumes a fixed rate. Real loans can have rate resets, fees, or structures the calculator can’t model perfectly.

- No substitute for advice. It’s a planning tool, not a personalized financial plan. Helpful, but not a crystal ball.

Tips for Smarter Aircraft Financing

- Shop around. Compare lenders—not just the APR, but terms, fees, and prepayment rules.

- Revisit the down payment. More down usually means lower total interest and better approval odds. Sometimes a lot better.

- Budget the whole airplane. Fuel, insurance, hangar, maintenance reserves—build them into your monthly picture, not as an afterthought.

- Consider balloon structures (carefully). Lower payments now, big lump at the end. Works for some missions; risky if resale or cash isn’t lined up.

- Talk to aviation specialists. Niche lenders know airframes, logbooks, and market values—often translating to cleaner terms and fewer surprises.

FAQ: Aircraft Finance Calculators

Q1: Are aircraft finance calculators accurate?

Accurate enough for planning, not for contracts. They’re solid estimates, but final payments hinge on the lender’s exact terms, fees, and structure (fixed vs. variable, balloons, etc.).

Q2: What’s a typical down payment?

Most buyers put 15–20% down. Older or specialty aircraft may require more; pristine credit and strong financials can sometimes pull it lower.

Q3: Do lenders finance older airplanes?

Yes—just expect a closer look at logs and engine times, and often a higher rate or shorter term. Age and supportability matter.

Q4: Can I lease instead of finance?

You can. Operating or finance leases exist, mostly on the business side, and they’re less common than plain loans in GA. Still worth a quote.

Q5: Should I use a generic loan calculator?

Better to use an aviation-specific one. It speaks the right language—maintenance reserves, insurance, and other ownership costs many generic tools ignore.

Conclusion

An aircraft finance calculator is an essential tool for anyone considering buying a plane in 2025. By providing quick, clear payment estimates, it helps buyers plan realistically and avoid financial surprises.

Whether you’re purchasing your first light aircraft or financing a business jet, using the right calculator and comparing lenders ensures you make a smart decision. Pair this with strong budgeting tools and financial planning strategies to keep your aviation dream affordable.

Leave a Reply