Introduction to Alternative Investments Club

Imagine walking into a private room where high-net-worth individuals quietly exchange investment opportunities you’ve never heard of—art funds, rare collectibles, private equity, even farmland. No CNBC coverage, no flashy headlines, just insiders multiplying their wealth while the masses stick to stocks and bonds.

That’s the world of an Alternative Investments Club a powerful community where you gain access, knowledge, and opportunities usually reserved for the elite. If you’ve ever felt like the traditional market isn’t enough, this guide will reveal why these clubs might be your missing wealth strategy.

What Is an Alternative Investments Club?

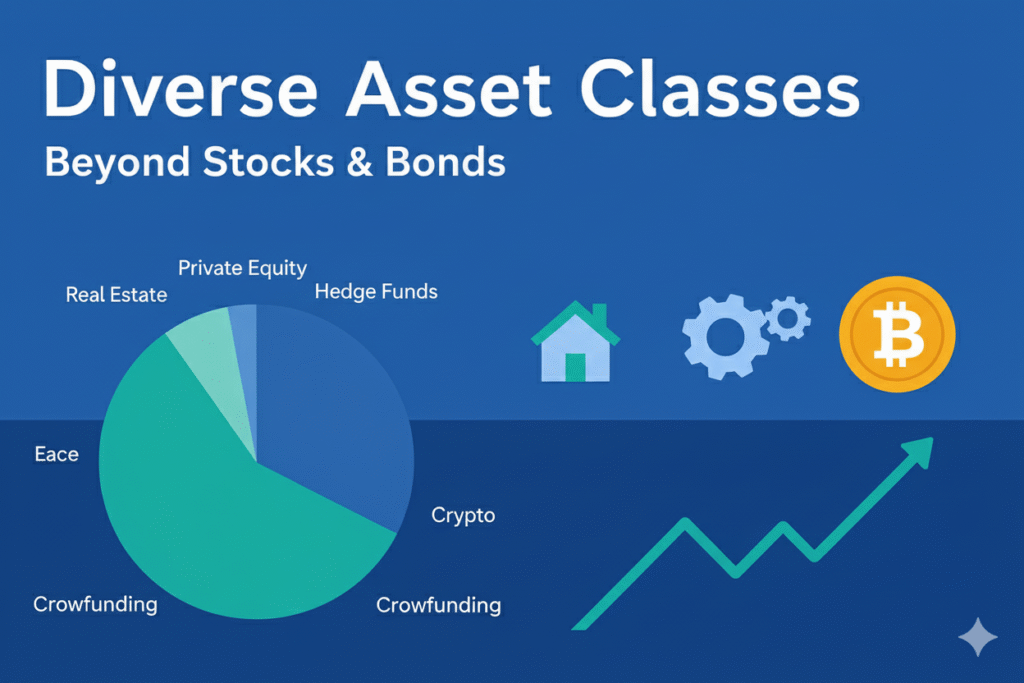

An Alternative Investments Club is a private group of investors who pool knowledge, resources, and sometimes capital to explore non-traditional asset classes. These go beyond stocks, bonds, and mutual funds, offering access to:

- Private Equity & Venture Capital

- Hedge Funds

- Real Estate Syndications

- Art, Wine, and Collectibles

- Commodities & Precious Metals

- Crypto & Blockchain Projects

Unlike mainstream investments, these require insider knowledge, due diligence, and often higher entry points. A club bridges that gap by creating collective intelligence and shared opportunity access.

What Is an Alternative Investments Club?

An Alternative Investments Club is a private group of investors who pool knowledge, resources, and sometimes capital to explore non-traditional asset classes. These go beyond stocks, bonds, and mutual funds, offering access to:

- Private Equity & Venture Capital

- Hedge Funds

- Real Estate Syndications

- Art, Wine, and Collectibles

- Commodities & Precious Metals

- Crypto & Blockchain Projects

Unlike mainstream investments, these require insider knowledge, due diligence, and often higher entry points. A club bridges that gap by creating collective intelligence and shared opportunity access.

Why Join an Alternative Investments Club?

1. Exclusive Deal Flow

Most alternative investments never hit the public market. Through clubs, you tap into private deals and early-stage opportunities.

2. Shared Expertise

Imagine 20 sharp investors dissecting a real estate deal. You’re not just investing—you’re learning through collective brainpower.

3. Risk Diversification

Adding alternatives like real estate, art, or commodities shields you from stock market volatility.

4. Networking & Mentorship

Wealthy circles breed wealthy conversations. The relationships you build in these clubs often open doors beyond investments.

Types of Alternative Investment Clubs

1. Real Estate Investment Clubs

Focus on syndications, REITs, and off-market property deals.

2. Private Equity & Venture Capital Groups

Early-stage startups, private company shares, and growth funds.

3. Collectibles & Passion Asset Circles

Wine, art, vintage cars, watches—investments driven by scarcity and demand.

3. Collectibles & Passion Asset Circles

Wine, art, vintage cars, watches—investments driven by scarcity and demand.

4. Hybrid Wealth Clubs

A mix of multiple asset classes for maximum diversification.

How Alternative Investment Clubs Work

Think of them as financial masterminds. Here’s the typical model:

- Membership Screening – Many clubs accept only accredited investors.

- Capital Pooling – Members may pool funds for larger opportunities.

- Expert-Led Sessions – Regular meetings include deal pitches, analysis, and guest experts.

- Shared Resources – Legal, financial, and market insights are shared among members.

- Decision Autonomy – Each member decides whether to participate in deals.

Who Should Consider Joining?

These clubs aren’t for everyone. They’re best suited for:

- Accredited Investors looking beyond stocks and ETFs.

- Entrepreneurs & Professionals eager to diversify wealth.

- Collectors with passion for niche assets like art or wine.

- Curious Learners willing to explore complex financial opportunities.

Warning: If you’re not comfortable with higher risk, illiquidity, or long investment horizons, traditional markets may be a safer bet.

How to Find and Join an Alternative Investments Club

Here are practical steps to get started:

- Research Local & Global Clubs

Look for established groups in your city or online communities. - Check Investor Forums & LinkedIn Groups

Many exclusive clubs recruit through professional networks. - Attend Finance & Wealth Conferences

These often feature private investor meetups. - Start Your Own Club

If none fit, build your circle. All you need is a group of like-minded investors and access to opportunities.

Future of Alternative Investment Clubs

With technology, blockchain, and global wealth shifts, these clubs are becoming more accessible. Tokenization of assets (fractional ownership in art or real estate) will open doors to younger investors, democratizing opportunities once reserved for billionaires.

Imagine owning a fraction of a Picasso or co-investing in a Silicon Valley startup—all from your laptop. The clubs of the future will combine exclusivity with accessibility.

Frequently Asked Questions (FAQs)

1. What exactly is an alternative investment?

An alternative investment is any asset outside traditional stocks, bonds, or mutual funds. Examples include real estate, hedge funds, private equity, art, wine, collectibles, and cryptocurrencies

2. Do I need to be wealthy to join an alternative investments club?

Not always. While some clubs cater to accredited investors with high entry minimums, others are more accessible and allow smaller contributions or fractional ownership.

3. Are alternative investments risky?

Yes, they can be riskier due to illiquidity, lack of regulation, and complexity. However, they also offer higher potential returns and portfolio diversification. Proper due diligence is essential.

4. How can I find a legitimate alternative investments club?

Start by researching local investor associations, checking LinkedIn groups, or attending wealth and finance conferences. Always verify the club’s credibility, leadership, and track record before joining.

5. Can I start my own alternative investments club?

Absolutely. Many successful clubs began as small groups of professionals pooling money and knowledge. You’ll need a clear structure, trusted members, legal guidance, and access to deals.

Conclusion

Joining an Alternative Investments Club isn’t just about chasing returns—it’s about expanding your access to wealth strategies that go far beyond Wall Street. If you’ve ever felt limited by stocks and mutual funds, this may be the secret pathway to building generational wealth.

Leave a Reply