Managing money in today’s fast-paced digital world is challenging. With endless bills, subscriptions, and financial goals, it’s easy to lose track of where your money goes. That’s where zero-based budget apps come in. These apps make sure every dollar you earn has a purpose. They help you cut wasteful spending and gain control of your finances.

In this guide, we’ll look at what zero-based budgeting is, why it works, and the best zero-based budget apps in 2025 that can help you achieve financial freedom.

What Is Zero Based Budgeting?

The Core Principle Behind Zero Based Budgeting

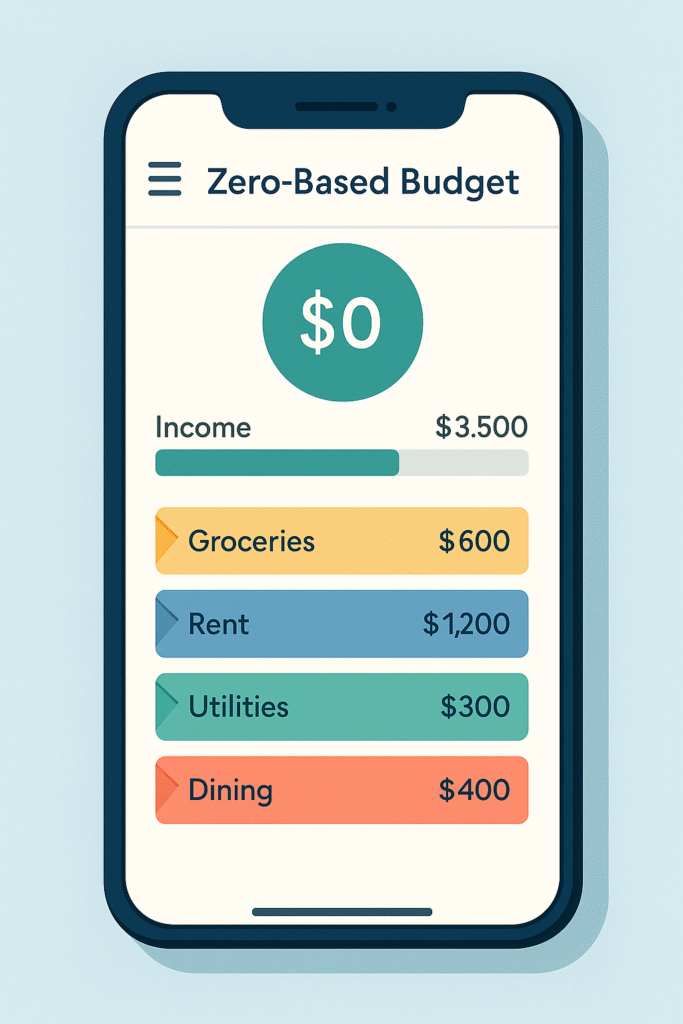

Zero based budgeting is a straightforward but effective financial system. Every dollar of your income is assigned a job, whether it’s for bills, debt repayment, savings, or discretionary spending. At the end of the month, your budget should balance to zero.

Why Zero Based Budgeting Works for Modern Money Management

Unlike traditional budgeting, where some money may go unused, zero based budgeting makes sure that nothing is wasted. It keeps you accountable, intentional, and focused on reaching your financial goals.

Benefits of Using Zero Based Budget Apps in 2025

Complete Control Over Every Dollar

Zero-based budget apps give you a clear plan for every cent you earn. They remove financial guesswork.

Reduces Wasteful Spending

By assigning money to categories, you’ll notice bad spending habits more quickly and adjust as needed.

Encourages Goal-Oriented Saving

These apps help you focus on your financial priorities, whether you’re building an emergency fund or planning a vacation.

Key Features to Look for in Zero Based Budget Apps

- User-Friendly Interface: Budgeting should be simple. It should not be stressful.

- Bank Synchronization and Automation: Automatic expense tracking makes budgeting easy.

- Expense Reports and Analytics: Visual insights help you see spending habits.

- Security and Data Protection: Make sure the app has strong encryption and multi-factor authentication.

Zero Based Budgeting vs. Envelope Budgeting Apps

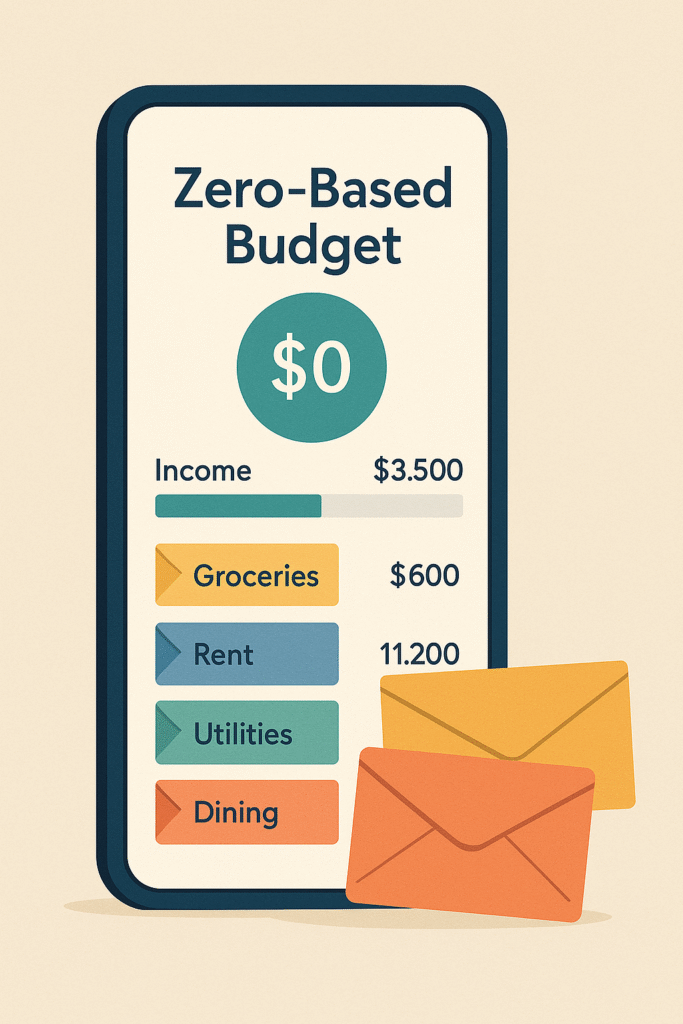

While zero-based budgeting focuses on giving every dollar a job, envelope budgeting takes a different approach by dividing money into specific categories for spending.

- Zero-Based Budget Apps: ensure that all income is accounted for and assigned each month, leaving no dollar unassigned.

- Envelope Budgeting Apps: on the other hand, let you visually separate money into categories like groceries, rent, and entertainment. This makes it easier to control spending in specific areas.

Top 6 Best Zero Based Budget Apps in 2025

YNAB is a one of the most popular apps, YNAB uses a true zero-based budgeting system. It’s perfect for users who want detailed tracking and goal setting.

Created by Dave Ramsey, this app is ideal for those on a debt-free journey. It’s easy to use and works well with zero-based budgeting.

3. Goodbudget

This app mixes envelope budgeting with zero-based budgeting, making it a great choice for hands-on budgeters.

4. PocketGuard

A modern app that helps you avoid overspending while sticking to your zero-based plan.

5. Fudget

Minimalist and straightforward, Fudget is perfect for beginners who want simplicity in their budgeting.

Best for couples and families, Zeta combines zero-based budgeting with shared expense tracking.

How Zero Based Budget Apps Help You Achieve Financial Freedom

- Paying Off Debt Faster, Extra dollars can be applied directly to loans.

- Building Emergency Savings, It’s important to be ready for the unexpected.

- Planning for Long-Term Goals, Save for vacations, retirement, or buying a home.

Common Mistakes to Avoid with Zero Based Budget Apps

- Creating too many categories makes budgeting overwhelming.

- Ignoring the insights and reminders that apps provide.

- Constantly switching apps instead of using one system.

FAQs About Zero Based Budget Apps

Q.1: Are zero-based budget apps free to use?

Some apps, like Fudget and Zeta, are free. Others, like YNAB, charge a subscription.

Q.2: Which zero-based budget app is best for beginners?

EveryDollar and Fudget are easy for beginners to use.

Q.3: Can these apps replace traditional budgeting methods?

Yes, they are more efficient because they track spending automatically and provide instant insights.

Q.4: Are zero-based budget apps safe to link with bank accounts?

Most apps use bank-level security. Always check before connecting your accounts.

Q.5: How do zero-based budget apps help with debt repayment?

They let you focus on paying down debt and help you stick to your plan.

Conclusion: Choosing the Best Zero Based Budget App for Your Needs in 2025

Zero based budgeting is one of the best ways to manage money in today’s digital world. By making sure that every dollar has a purpose, you gain clarity, control, and confidence in your finances.

If you want something simple, try Fudget or EveryDollar. For more experienced users, YNAB provides a complete system. Couples may find Zeta especially useful.

No matter which app you pick, remember that the key to financial success is consistency and discipline. Use these zero based budget apps in 2025 to stay on track and reach your financial goals.

Leave a Reply