What Is a Bridging Finance Calculator?

A bridging finance calculator is an online tool that estimates the true cost of a bridging loan based on a few key inputs.

It typically calculates:

Monthly or rolled-up interest

Total interest over the loan term

Fees (arrangement, exit, valuation)

Total repayment amount

You may also see it referred to as a:

bridging loan calculator

bridging finance interest calculator

bridging loan cost calculator

short-term property finance calculator

While names vary, the goal is the same: clear cost visibility before borrowing.

What Is Bridging Finance?

Bridging finance (or a bridging loan) is short-term property finance designed to “bridge” a funding gap. It’s commonly used when:

You need to buy before selling another property

You’re purchasing at auction

There’s a chain break

You’re funding a refurbishment or development

These loans are usually short-term (1–18 months) and come with higher interest rates than standard mortgages due to speed and flexibility.

Because costs add up quickly, using a bridging loan calculator before committing is critical.

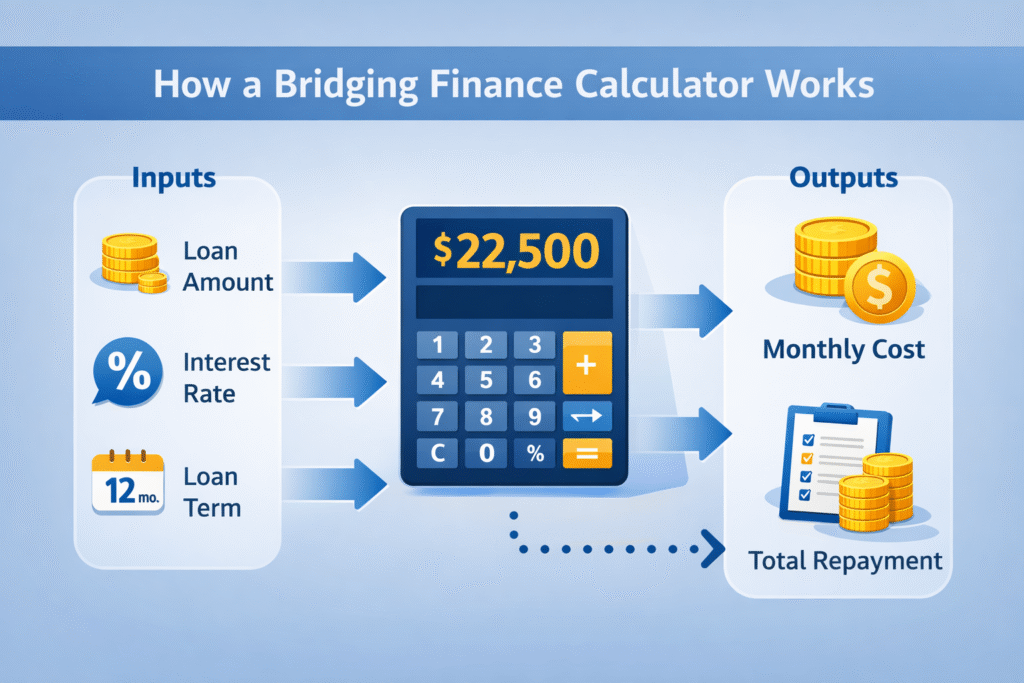

How a Bridging Finance Calculator Works

A reliable bridging finance calculator works by combining loan details and lender charges to produce a realistic cost estimate.

Typical Inputs

You’ll usually need to enter:

Loan amount – how much you’re borrowing

Interest rate (monthly %) – e.g., 0.75%–1.25% per month

Loan term – number of months (e.g., 6 or 12)

Arrangement fee – often 1%–2% of the loan

Exit fee (if applicable)

Typical Outputs

The calculator then shows:

Monthly interest cost

Total interest payable

Total fees

Overall repayment amount

This is why a bridging loan cost calculator is far more useful than just looking at interest rates alone.

Bridging Finance Calculator Formula (Simple Explanation)

You don’t need complex maths to understand how to calculate bridging finance.

Here’s the logic in plain English:

Take the loan amount

Multiply it by the monthly interest rate

Multiply that by the number of months

Add fees (arrangement + exit)

Combine everything to get total repayment

Simplified Formula

Total Interest = Loan Amount × Monthly Interest Rate × Loan Term

Total Cost = Total Interest + Fees

Total Repayment = Loan Amount + Total Cost

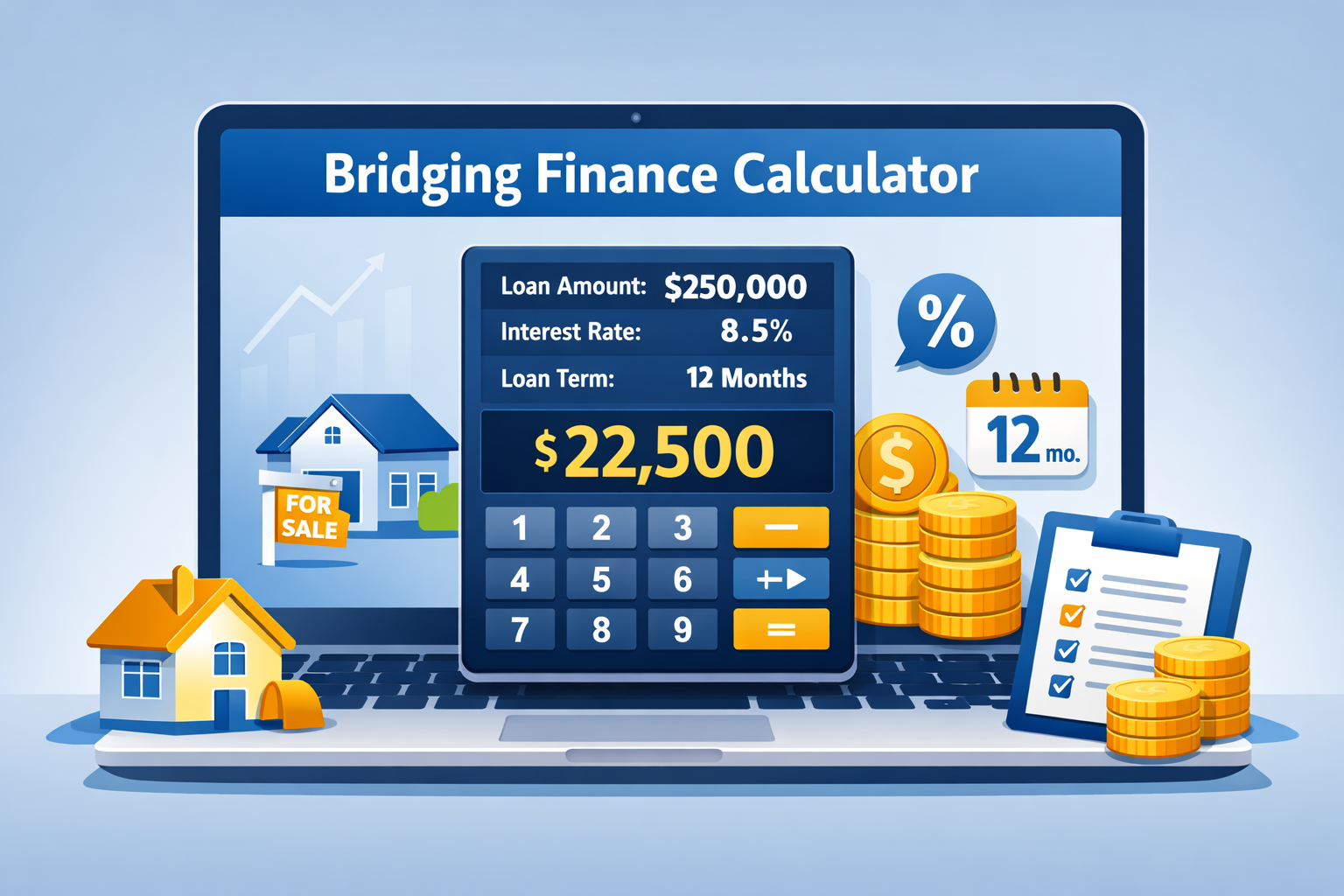

Example Calculation (Real-World Scenario)

Let’s walk through a realistic example using a bridging finance calculator.

Scenario

Loan amount: £300,000

Interest rate: 0.9% per month

Loan term: 9 months

Arrangement fee: 2%

Exit fee: None

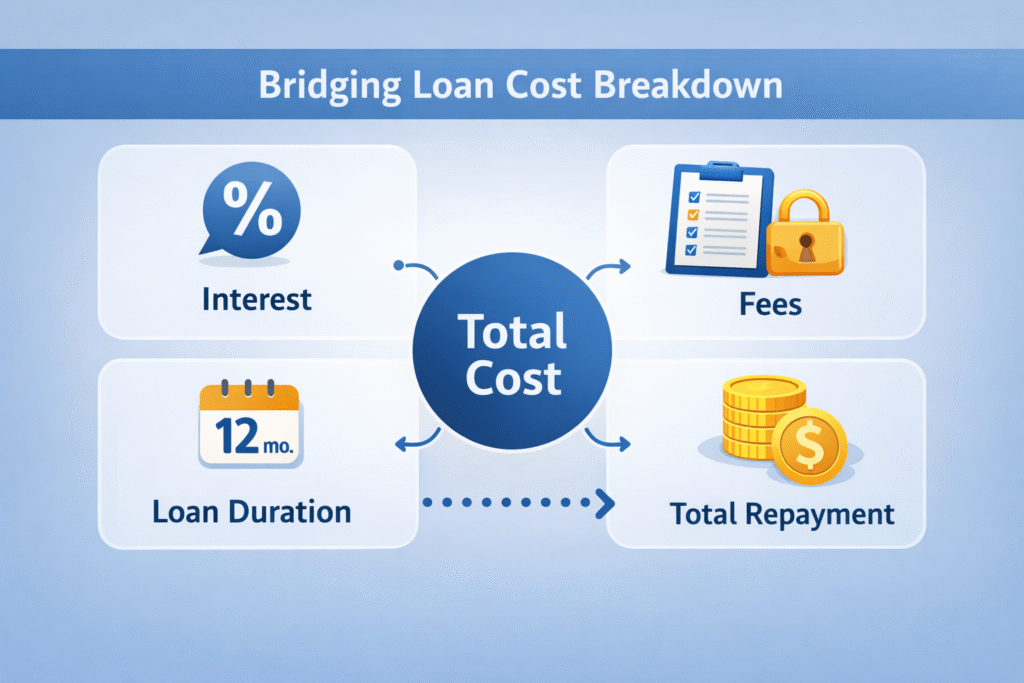

Key Factors That Affect Bridging Finance Costs

Even with a calculator, it’s important to understand what influences the final numbers.

1. Interest Rate

Bridging loans are priced monthly, not annually. Small differences (0.8% vs 1.0%) can mean thousands in extra cost.

2. Loan Duration

The longer the loan runs, the higher the interest. Keeping the term short is one of the best ways to reduce costs.

3. Loan-to-Value (LTV)

Lower LTV loans usually attract better rates. Higher LTV increases lender risk—and cost.

4. Fees & Exit Strategy

Arrangement fees, exit fees, valuation costs, and legal fees all impact the final figure. Some calculators don’t include all of these by default.

This is why using a bridging loan cost calculator with adjustable inputs is essential.

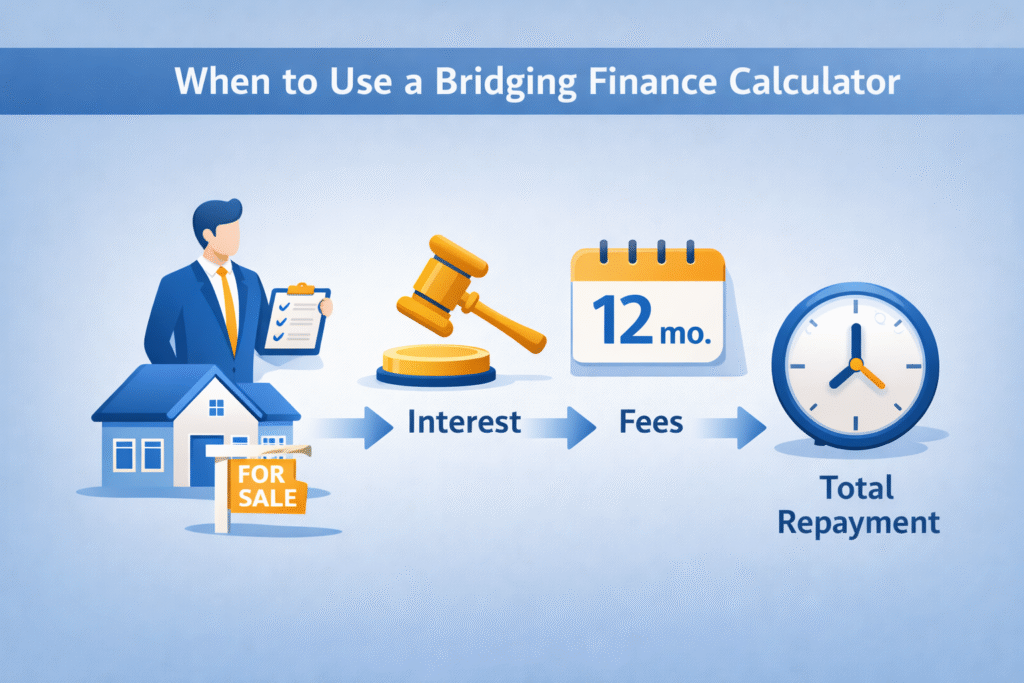

When Should You Use a Bridging Loan Calculator?

You should always use a bridging finance calculator before applying, especially in these scenarios:

Auction purchases (tight completion deadlines)

Chain breaks in residential transactions

Refurbishment or light development projects

Time-sensitive investment opportunities

Buying before selling an existing property

If speed matters, cost clarity matters even more.

Limitations of a Bridging Finance Calculator

While extremely useful, calculators are still estimates.

What They Can’t Fully Predict

Lender-specific underwriting adjustments

Credit profile impact on rates

Unexpected extension fees

Market or valuation changes

Think of a bridging loan calculator as a planning tool—not a final offer.

Tips to Reduce Bridging Finance Costs

Before applying, use your calculator strategically.

Smart Cost-Saving Tips

Keep the loan term as short as possible

Choose lower LTV where feasible

Avoid unnecessary extensions

Compare multiple lenders

Have a clear, realistic exit strategy

Re-running your numbers in a bridging finance interest calculator after each adjustment can save you thousands.

Conclusion:

A bridging finance calculator is one of the most important tools in short-term property finance.

Key points to remember:

Bridging loans are fast—but expensive if misunderstood

A calculator shows true cost, not just rates

Always factor in fees and loan duration

Compare monthly vs rolled-up interest

Use estimates to negotiate smarter deals

Before you apply for any bridging loan, estimate your costs first. A few minutes with a bridging loan calculator can protect your profit—and your peace of mind.

Frequently Asked Questions (FAQ)

How accurate is a bridging finance calculator?

Most calculators are highly accurate for estimates, but final costs depend on lender terms, valuation, and credit profile.

Does a bridging loan calculator include fees?

Some do, some don’t. Always check if arrangement and exit fees are included or added separately.

Is bridging finance expensive?

Yes, compared to standard mortgages. However, when used short-term with a clear exit, it can be cost-effective for time-sensitive deals.

How long can bridging finance last?

Typically 1 to 18 months, though some lenders offer up to 24 months in special cases.

Leave a Reply