Introduction to UHB Investments

In today’s fast-moving financial world, one question is popping up more and more: What exactly are UHB Investments, and how do they work?

UHB Investments are part of a rising trend in modern wealth-building. They’re designed with diversification, long-term growth, and sustainability in mind—often blending real estate, equities, and strategic assets into a single, powerful portfolio. Whether you’re just starting out or you’ve been investing for years, understanding how UHB Investments work in 2025 is key to staying ahead.

In this guide, we’ll break it all down. You’ll learn what UHB Investments are, how they operate, the potential benefits (and risks), and how to decide if they belong in your financial game plan.

👉 Related Read: If you’re exploring financial tools, check our guide on Dave Ramsey Investment Calculator for retirement planning.

What are UHB Investments?

UHB Investments aren’t just a one-size-fits-all product—they’re structured, diversified portfolios designed to balance risk and reward. Here’s what’s usually in the mix:

- Stocks & Equities – These often include a blend of blue-chip companies for stability and growth stocks for higher returns.

- Real Estate – Both commercial and residential properties are common, offering consistent income and long-term appreciation.

- Fixed-Income Assets – Think government bonds, treasury notes, and other low-risk instruments that provide steady returns.

- Alternative Assets – This bucket might include ESG (Environmental, Social, and Governance) funds, REITs (Real Estate Investment Trusts), or even private equity for added diversity.

According to Investopedia, diversified portfolios like UHB models help balance risk and return, making them attractive for long-term investors.

Why Consider UHB Investments in 2025?

If you’re thinking long-term and want to future-proof your finances, UHB Investments offer a smart, strategic option. Here’s why they’re catching attention this year:

Built-In Diversification

UHB portfolios spread your money across stocks, real estate, bonds, and alternatives, reducing your exposure to any one type of risk.

Long-Term Stability

Markets can be unpredictable—but UHB investments are structured to ride out the ups and downs with a more balanced, resilient approach.

Strong Growth Potential

With access to high-performing equities and real estate, these portfolios offer real room for wealth building over time.

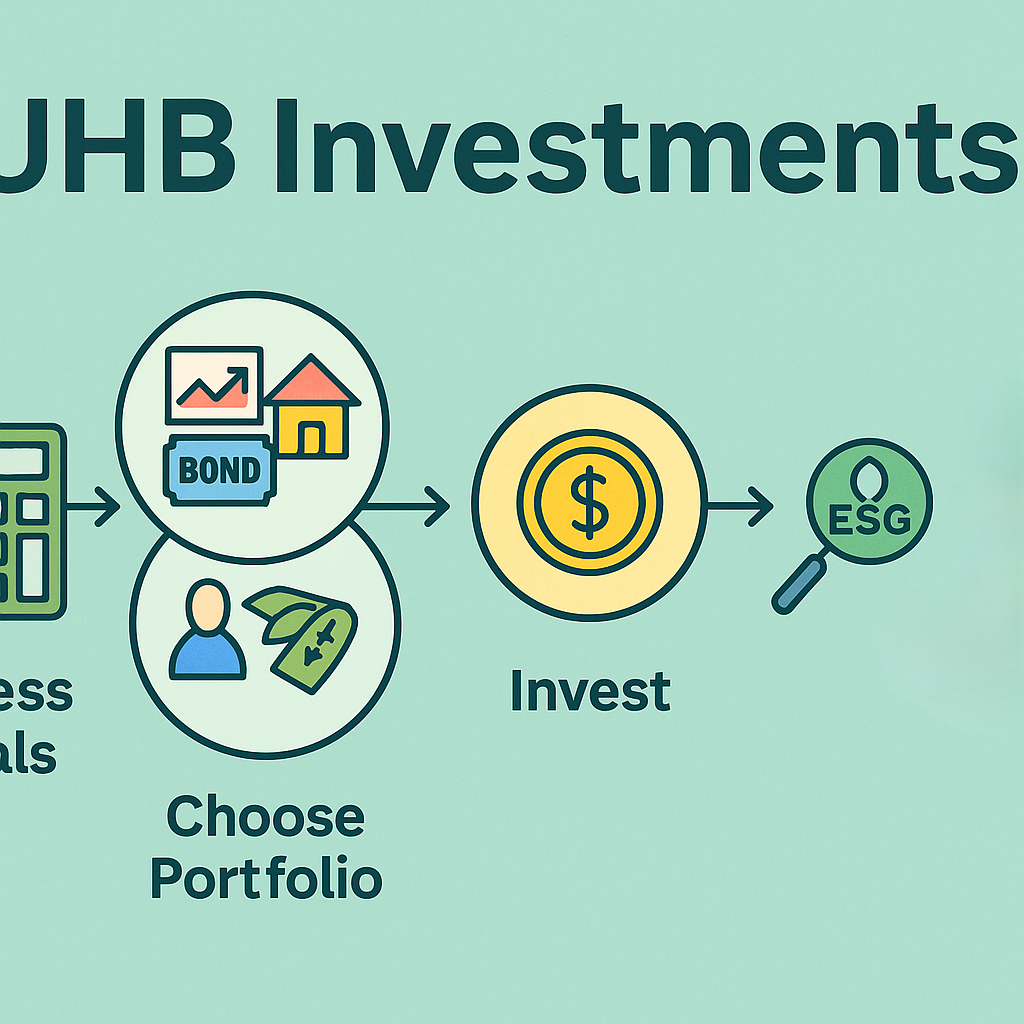

How UHB Investments Work

They aren’t just a random mix of assets—they’re carefully structured and actively managed to align with your financial goals. Here’s a breakdown of how they operate:

Portfolio Structuring

The first step is building a portfolio with diverse assets—spanning different industries, regions, and investment types to spread risk and maximize opportunity.

Risk Assessment

Your personal risk tolerance and financial goals guide the process. Whether you’re more conservative or open to aggressive growth, the portfolio is tailored to match.

Ongoing Management

Depending on the strategy, the portfolio can be actively managed by professionals who make regular adjustments—or passively managed to follow a market index.

Performance Tracking

To keep everything on course, UHB portfolios are monitored and rebalanced regularly—making sure your asset mix stays aligned with your strategy.

Benefits of UHB Investments

- Steady Long-Term Growth – By blending high-growth assets with stable ones, UHB portfolios aim for sustainable returns over time.

- Built-In Diversification – With exposure to stocks, real estate, bonds, and alternatives, your risk is naturally spread out.

- Tax Advantages – Depending on how the investment is structured, you might qualify for tax breaks or deferred gains.

- Pro Management Options – You can choose to have your portfolio professionally managed, saving time and ensuring expertise guides your decisions.

Risks of UHB Investments

- Market Volatility – Stocks can swing sharply, especially in uncertain economic climates—impacting part of your portfolio.

- Real Estate Liquidity – Unlike stocks, properties can’t always be sold quickly, which may limit your access to funds.

- Interest Rate Sensitivity – Bond values can dip when interest rates rise, affecting the fixed-income portion of your portfolio.

- Regulatory Risks – ESG-focused and alternative assets can be subject to changing rules and government oversight, which may impact returns.

FAQs About UHB Investments

Q1: Are UHB Investments safe?

They offer diversified safety but carry normal market risks.

Q2: Can beginners invest in UHB portfolios?

Yes, many platforms provide beginner-friendly options.

Q3: What’s the minimum investment?

Depends on provider—some allow $500, others require $10,000+.

Q4: Do UHB Investments include real estate?

Yes, many include real estate and REITs.

Q5: Are UHB Investments tax-efficient?

Some are structured with tax benefits, depending on jurisdiction.

Conclusion

In 2025, UHB Investments offer a smart, future-ready approach to building and preserving wealth. By blending equities, real estate, bonds, and ESG assets, these portfolios strike a balance between growth, stability, and sustainability.

For investors who want to grow their money while staying aligned with long-term goals and modern values, they are definitely worth a closer look. Whether you’re just starting out or rebalancing a mature portfolio, they could be the strategic edge you need in today’s evolving financial landscape.

Leave a Reply